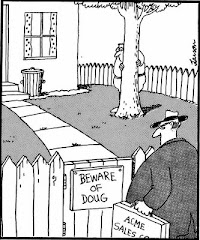

Words to live by...

"How beautiful it is to do nothing, and to rest afterward."

[Spanish Proverb]

(The right to looseness has been officially given)

"Everyone carries a part of society on his shoulders," wrote Ludwig von Mises, "no one is relieved of his share of responsibility by others. And no one can find a safe way for himself if society is sweeping towards destruction. Therefore everyone, in his own interest, must thrust himself vigorously into the intellectual battle."

Apparently, the crossword puzzle that disappeared from the blog, came back.

The ruling on Obamacare

I personally think the USSC's ruling on the Affordable Care Act was wrong. But it stands. A lot of things I think are wrong stand. I'm used to that.

To understand my position, you have to remember I was born before Medicare came into existence, back when health insurance coverage was rare, back when doctors still made housecalls. When Medicare was being proposed, the AMA was opposed to it. Many of the same arguments that have been brought up for ACA were used against Medicare; it was "socialized medicine", it would cost way more than projected, and so on. It passed anyway. It is partially "socialized medicine" and its costs are way more than were projected.

ACA is not socialized medicine, it is not even socialized insurance coverage. What it is is an unknown. We do not know yet what it will cost. Based on Medicare, it will cost way more than anyone can predict. It will not directly impact me as I am covered and have been for many years. I am safe from having a penalty/tax imposed on me for lack of coverage.

What it proposes will happen probably won't happen. It will not bring health insurance rates down. It will not bring health care costs down. Simply mandating people buy health insurance will not have any impact on insurance costs because there is no incentive built in to do that. Insurance companies have been mandated to provide more coverage under the law and there is nothing in the law, so far as I can learn, that prevents them from passing on the costs for that coverage onto policy holders.

The Court addresses this:

The reforms also threaten to impose massive new costs on insurers, who are required to accept unhealthy individuals but prohibited from charging them rates necessary to pay for their coverage. This will lead insurers to significantly increase premiums on everyone. See Brief for America’s Health Insurance Plans et al. as Amici Curiae in No. 11– 393 etc. 8–9.

The individual mandate was Congress’s solution to these problems. By requiring that individuals purchase health insurance, the mandate prevents cost-shifting by those who would otherwise go without it. In addition, the mandate forces into the insurance risk pool more healthy individuals, whose premiums on average will be higher than their health care expenses. This allows insurers to subsidize the costs of covering the unhealthy individuals the reforms require them to accept. The Government claims that Congress has power under the Commerce and Necessary and Proper Clauses to enact this solution.

The theory is that forcing those healthy people who opt out of coverage to get coverage will increase the pool and, thereby, bring down the premiums is weak. What is likely to happen is what Medicare created: a larger number of people using health care because it is now covered. If you have health insurance, you will use it.

That may be a good thing. But Medicare didn't reduce cost of that health care. It increased pressure on health care providers to provide service for more people. It has filled waiting rooms. It has meant longer waits to see a doctor and shorter times with the doctor. If you like crowded waiting rooms and long wait times then you should be happy about this ruling.

What other effects it will have on health care are entirely unknown. We are entering the foggy realm of unintended consequences.

What I do know is that the chances of having this law repealed have been reduced to near zero. Even if it is repealed, it will be replaced by something so similar as to be indistinguishable. Or maybe by something worse.

Of course, I am a cynic... optimists may have a different opinion.

Another thing which bothers me in the ruling is that the "penalty" is now a "tax." I do not understand this because how do you tax a non-product, a non-transaction. Essentially, Roberts (and, thus, the majority) said Congress can tax something which does not exist (the policy) or did not happen (the purchase of that policy).

That scares me... what can Congress not tax then?

1 comment:

A lot of things can happen in 2700 pages.

Post a Comment