Words to live by...

"How beautiful it is to do nothing, and to rest afterward."

[Spanish Proverb]

(The right to looseness has been officially given)

"Everyone carries a part of society on his shoulders," wrote Ludwig von Mises, "no one is relieved of his share of responsibility by others. And no one can find a safe way for himself if society is sweeping towards destruction. Therefore everyone, in his own interest, must thrust himself vigorously into the intellectual battle."

Apparently, the crossword puzzle that disappeared from the blog, came back.

Are you paying your fair share?

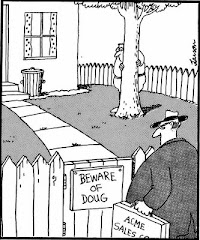

People are sometimes a puzzle to me. I'll give you an example...

A man calls into Rush Limbaugh's show, says he's 24 and he wondered why we couldn't cut "corporate welfare, tax breaks for the very rich, [and so on]?" Did he not realize who he was talking to? Did he really think no one had argued that to Limbaugh before?

I see this all the time, it seems. People talk about how the "rich should pay their fair share" without defining the term "fair share." What, exactly, is a "fair share" of one's income?

Let me relate something that happened to me. I once belonged to a union, Communications Workers of America (which, at the time I joined was strictly composed of members who worked in the telecommunications industry). At the time, the dues was a measly $8 a month. Very cheap. And it applied to all members regardless of what they earned. Later, around 1974 or 1975, the dues was changed to the equivalent of 2 hours pay per month. Since I was making $250 a week at the time, that meant my dues went to $12.50 a month. Still not a lot of money and I could easily afford it. But then I began thinking about the "fairness" of it. You see, I was told this dues structure was more "fair."

I wondered... Did I get more representation than, say, an operator who made about 60% of my pay? Or a frame attendant (who made 80%)? No, I got the same representation. I was told I should pay more because the union had negotiated the pay I got.

It still did not make sense to me. They also negotiated the pay of those who earned less than I did. The union didn't get me the job, it didn't qualify me to work in that position. In fact, they did nothing except represent me in disputes and every three years when the contract came up. The only "fairness" I could see was that I made more so I could pay the union more.

Let's apply that to taxes. What is so special about making more than $250,000 a year in taxable income? Why should people be penalized for succeeding? How is paying a greater rate than someone who makes $50,000 a year "fair?" The higher income earner doesn't get anything more from the government than the person making less. What he does get is a nicer home in a better neighborhood, both of which he pays for. The government does not subsidize him.

On the other hand, the person making $22,000 a year and with a wife and two kids is squarely in the poverty range and becomes eligible for all kinds of programs. He also does not pay a dime in income tax. He gets more services from government than the "rich" guy does but pays nothing for them.

Your tax bracket is the rate you pay on the "last dollar" you earn; but as a percentage of your income, your tax rate is generally less than that. First, here are the tax rates and the income ranges where they apply:

"To take an example, suppose your taxable income (after deductions and exemptions) was exactly $100,000 in 2008 and your status was Married filing separately; then your tax would be calculated like this:

( $ 8,025 minus 0 ) x .10 : $ 802.50

( 32,550 minus 8,025 ) x .15 : 3,678.75

( 65,725 minus 32,550 ) x .25 : 8,293.75

( 100,000 minus 65,725 ) x .28 : 9,597.00

Total: $ 22,372.00

This puts you in the 28% tax bracket, since that's the highest rate applied to any of your income; but as a percentage of the whole $100,000, your tax is about 22.37%."

http://www.moneychimp.com/features/tax_brackets.htm

So, someone with a taxable income of $100,000 will pay the government the equivalent of what that poor guy makes under the current tax rates.

Is that fair? Is that really his "fair share?"

We talk about taxing the rich as if they do not pay any taxes. But that is patently untrue, they pay most of the taxes. It is only the poor who pay no taxes.

The following is about the Bush tax cuts...

In 2002 the latest year of available data, the top 5 percent of taxpayers paid more than one-half (53.8 percent) of all individual income taxes, but reported roughly one-third (30.6 percent) of income.

The top 1 percent of taxpayers paid 33.7 percent of all individual income taxes in 2002. This group of taxpayers has paid more than 30 percent of individual income taxes since 1995. Moreover, since 1990 this group’s tax share has grown faster than their income share.

Taxpayers who rank in the top 50 percent of taxpayers by income pay virtually all individual income taxes. In all years since 1990, taxpayers in this group have paid over 94 percent of all individual income taxes. In 2000, 2001, and 2002, this group paid over 96 percent of the total.

Treasury Department analysts credit President Bush's tax cuts with shifting a larger share of the individual income taxes paid to higher income taxpayers. In 2005, says the Treasury, when most of the tax cut provisions are fully in effect (e.g., lower tax rates, the $1,000 child credit, marriage penalty relief), the projected tax share for lower-income taxpayers will fall, while the tax share for higher-income taxpayers will rise.

The share of taxes paid by the bottom 50 percent of taxpayers will fall from 4.1 percent to 3.6 percent.

The share of taxes paid by the top 1 percent of taxpayers will rise from 32.3 percent to 33.7 percent.

The average tax rate for the bottom 50 percent of taxpayers falls by 27 percent as compared to a 13 percent decline for taxpayers in the top 1 percent.

http://usgovinfo.about.com/od/incometaxandtheirs/a/whopaysmost.htm

Just something to consider...

2 comments:

I used to think like you ... when I made more money. But now that I make less, I've revised my thinking. But, seriously, all you're saying is that the govt. needs revenue, so it taxes people who make money. What else is the IRS going to do? Try to squeeze money out of people who don't have any? You gotta go where the money is.

And don't forget, you're talking about Federal income taxes; but that's only a part of the equation. High earners, as we all know, exempt a lot of their income (anything over $100k) from SS tax -- which is a big chunk of our federal tax burden. The SS tax is regressive (and I think that's wrong).

Also, rich people make a larger portion of their income thru dividends and capital gains, which are taxed at a lower rate. And high income people also have more opportunities to live on expense account -- ask my friend the lawyer who drives a nice new Infinity, paid for by his firm.

What I am trying to say is that "fair share" is a misnomer in terms of taxes. I never made a lot of money and I have never been in the highest tax bracket. I actually support the idea of "means testing" when it comes to SS and Medicare benefits but it must be done carefully and re-visited regularly. I don't think those whose wealth is measured in the multiple millions should get either of those but if you tax them, they deserve it (under the concept of "equal under the law"). Personally, I support the flat tax concept with a baseline (also revisited regularly) for exemption.

Post a Comment