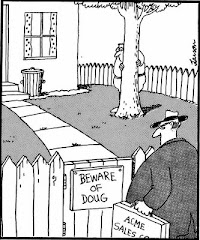

Words to live by...

"How beautiful it is to do nothing, and to rest afterward."

[Spanish Proverb]

(The right to looseness has been officially given)

"Everyone carries a part of society on his shoulders," wrote Ludwig von Mises, "no one is relieved of his share of responsibility by others. And no one can find a safe way for himself if society is sweeping towards destruction. Therefore everyone, in his own interest, must thrust himself vigorously into the intellectual battle."

Apparently, the crossword puzzle that disappeared from the blog, came back.

The tax cut that isn't

This was written before the House Republicans caved and agreed to accept the two month extension. Yes, I said "caved"... For a country looking for someone with principles, this may just be the final straw.

There's been quite a kerfuffle over the so called Obama "tax cut" for workers. This is the cut in the payroll tax (one of them, Social Security) by almost 30%. That is, from 6.2% to 4.2%. Sounds good, right? It is so important to the White House that the president vowed to veto it if the Keystone pipeline approval is included in the bill. That's right, keeping the pipeline on ice until 2013 is more important than the "tax cut for the middle class." I should say "was more important" because the veto threat disappeared when the Senate passed a bill with the pipeline approval and just a two month extension (not the year long one Obama demanded) of the payroll tax cut.

That cut being allowed to expire, it was said, would amount to a $1000 tax increase for people making $50,000 per year. And the Republicans are being presented as evil grinches who do not care about the middle class.

So let me explain what it actually means. Currently, you pay (if you are employed) 6.2% of your gross pay to Social Security. Up until recently this was called a "contribution" to Social Security where it would go into a "trust fund" and your subsequent benefits (when you reach 66) are calculated based on this "contribution" throughout your working life. The reality, of course, is the money you pay in goes to the people who are already receiving their Social Security benefits. The "trust fund" is mostly IOU's from Congress. (who has been borrowing from SS for decades now). But let's look at what that "tax cut" works out to be.

Let's say you make $50,000 per year before taxes. 2% of that is, indeed, $1000. But that is also before taxes. After taxes, it is less. Let's assume a 9% effective income tax rate. That means the $1000 is now $910. Then let's divide that by 52 (weeks in a year) and we have a whopping $17.50 per week. Or about the amount a family of four might spend to get a meal at McDonald's. Ok, the meal will likely be more than that.

But that $50,000 a year? How many people do you know that make that? Most people here in Paradise do not make that. They make less. Much less. My sister-in-law, for instance, who works for Publix Supermarkets, makes about $10 per hour. So that is $400 per week or $20800 a year. Her before income tax tax cut is $416 a year or $8 per week. Since she makes so little, she pays only a tiny percentage (about 6.2%) but that reduces the $8 to $7.50 a week.

Basically, this alleged tax cut is a lie. It has very little real impact on the people who do not make enough money to live and is undercutting Social Security at the same time.

Amazingly, for the first time in 3 years, the federal government has found it possible to give us Social Security recipients a cost of living (COLA) increase. We didn't have the money, they had said, for the first two years but now, in this coming election year, in spite of the payroll tax cut, there is money to give us a raise. Really? Never mind that this COLA increase will be wiped out by the increase in part B premiums which will kick in this next year also.

And what will happen if the House Republicans cave on this and a two month extension is passed? Well, we'll see yet another fight come late January and running up till the end of February just as we saw this month. And let's just suppose that fight results in an extension until the end of 2012. Will there be another fight to extend it yet another year? Because this economy is not going to turn around in 2012 and prices will still rise (as they have been doing throughout the last 3 years in spite of the government's denial of inflation). After two years, that "temporary" reduction will be seen as something permanent and anyone trying to end it will be blasted for "hiking taxes."

If you plan on voting for Obama in 2012, you are being flim-flammed... bamboozled... taken for a ride. You deserve what you get. I don't.

Have a Merry Christmas.

Apparently this post is a milestone. It is number 1000

3 comments:

Congrats on the 1000

People criticize Congress for being too extreme, too unreasonable, too beholden to their special interests. But then as soon as they agree on something, people say they've "caved" or "surrendered." Compromise is not a dirty word; it's what we want.

That being said, I agree that there's a little flim flam going on here over Social Security and the payroll tax. But I wouldn't blame it all on the Republicans who finally voted to extend the tax break.

Anyway congrats from me, too, on 1000 posts. And ... they're good ones!

Slight correction: honest compromise is what "we" want. There's nothing honest in this one.

Post a Comment