After golf today, I had to visit a financial planner. Not because I won a lot of money, it's just that Faye and I had an appointment with him. The thing is, one should get acquainted with a financial planner when they are in their early 30's. Then they should learn about what financial planning really is. And only after that should they start making some financial plans.

You see, it's a bit late to think about your old age when you are entering it. But most of us put it off until we look in the mirror and see one of our parents staring back at us. In my case, it was my father, and he/I was frowning. Oh, I put some money away in a long term savings plan my company had available which later was turned into a 401K. But not very much. I didn't take it seriously until I was in my mid-50's. Fortunately, Faye did take it seriously and pushed me to increase my "contribution" while I was in my 40's. Smartest move I ever made was to marry that woman...

So, in any event, we are now looking at ways to protect what we've saved and grow it a little bit, if possible.

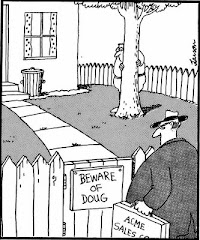

It's a bit like walking blindfolded through a minefield. I don't understand these things and the companies don't make it any easier on you. Have you ever actually read a prospectus? I've tried. I end up skimming the document looking for pitfalls. Sometimes I am successful and sometimes I am not.

The financial planner can help explain these to you. But only to his (or her) advantage. We are really at the mercy of people whose only purpose in life seems to be to divest you of every dime you ever put away. Well, I suppose that is how they make a living... sucking the lifeblood out of senior citizens. And it's an honest living, I am sure.

But now that I am home and able to do a little online research, I am not so sure that this financial planner is one whom I wish to trust with my savings. I am not sure I even trust me...

A Night Unremembered

15 years ago

No comments:

Post a Comment