So, the tax

Are any of the Bush tax cuts made permanent?

Are any tax cuts made permanent?

Is there a lot of extra spending in the bill?

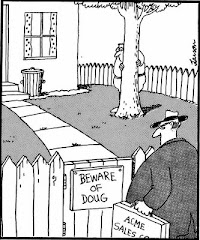

Why are these things (tax cuts) like Snake Oil?

The answers appear to be "No", "No", "Yes", and "It's politics, you idiot!"

Marketwatch.com sends me regular updates and links to articles they deem important to "savvy" investors. I am not sure who the parent company is or just how useful the articles are but I get them. I generally ignore the advice in them just as I ignore the advice from the investment "talking heads" on the 24 hour news channels. They don't have a clue, I think. Their "picks" of the week are usually trading at, or near, their 52 week highs. This is great... if you could make a profit buying high and selling low. I tried that once, didn't work out so well. But I digress, as usual.

Marketwatch sent me this link: What the New Tax Bill Means For You

Reading the summary (it is, after all, just a summary), I find the wonder of it all is that it is touted as a "big [no expletive needed to be deleted] deal" by Joe "Did I say that?" Biden, our Vice-President. You did know that Joe Biden was our Vice-President, didn't you? It's true. I have no idea how this happened either.

Maybe Joe was just being sarcastic. Everything in it expires by the end of 2012. Everything. Tax cuts for the middle class? End on December 31, 2012. All the extras? All end either on, or before, December 31, 2012. It should have been called the "let's postpone this for two years" bill. A clear case of kicking the can (of worms) down the road a bit. In fact, it actually raises taxes, it does not cut them. For instance, the Estate Tax* (aka "Death Tax") changes from 0% this year to 35% on estates over $5 million.

It also extends unemployment benefits for up to 13 months for many unemployed. This is being touted as a stimulus for the economy. This is because those struggling to live on those unemployment checks will spend all of it quickly so the money goes right back into the economy. I am told virtually all economists believe this. That explains why these same people are so surprised by what the economy actually does (always different than expected).

Plus (and the article fails to list them... or even mention they exist) there are all kinds of earmarks tossed in... something to the tune of $57 Billion worth.

In other words, this break we taxpayers are being given doesn't actually decrease any taxes, just prevents some from going up, does increase at least one, and adds a bunch of spending.

There is also a "cut" in payroll taxes. That is, the amount you pay to Social Security will be reduced from 6.2% to 4.2%. A mere drop in the bucket and will reduce your benefits just a tad

And this is fiscally responsible? I don't think so.

How about just cutting spending for a change? I don't mean reduce the increase by a nominal amount, I mean actually reducing all departments' budgets by, say, 5% from last year's? If something like this happens, Faye will also let me date Cheryl Tiegs on the side.

*The Estate Tax is, essentially, a tax on the heirs of the deceased. The accumulated wealth (whether liquid or as a family business) of the deceased is then taxed upon transference. Even if this wealth was already taxed as it accumulated. It affects businesses and farms because it quite easily could force the inheritors to sell such property in order to pay the tax.

3 comments:

Yep. You nailed it. But lets remember which president (and party) left office with a budget surplus and no wars, and which president (and party) left office with a world-breaking deficit and two wars.

GLS, I certainly will... if you remember which party was controlling Congress (House and Senate) when those things happened.

Yep. You nailed it. But lets remember which president (and party) left office with a budget surplus and no wars, and which president (and party) left office with a world-breaking deficit and two wars.

Post a Comment