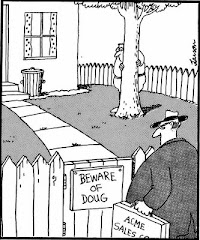

Words to live by...

"How beautiful it is to do nothing, and to rest afterward."

[Spanish Proverb]

(The right to looseness has been officially given)

"Everyone carries a part of society on his shoulders," wrote Ludwig von Mises, "no one is relieved of his share of responsibility by others. And no one can find a safe way for himself if society is sweeping towards destruction. Therefore everyone, in his own interest, must thrust himself vigorously into the intellectual battle."

Apparently, the crossword puzzle that disappeared from the blog, came back.

The Board Giveth, The Board Taketh Away

As some of you know, I indulge in some board games on my computer. One such game is Monopoly(tm) wherein I play the part of a ruthless capitalist out to destroy my competition. I usually succeed... mostly because I have figured out the weaknesses inherit in the way the computer players are coded in the game.

It does not work that way in real life, does it?

I was engaged in a little debate online with someone who brought up the issue of IPOs (Initial Public Offering, for those of you unfamiliar with the term) and how they were unfair.

He wasn't entirely wrong, the stock is valued by the company offering it and, I am sure, that price is subject to both SEC rules and other considerations. Wiki implies they are often under-priced. This is to ensure interest in the stock, I assume. But many companies, going public, do not need to generate interest beyond that of going public. There are any number of privately-held companies that investors are literally drooling to buy. Some not so much.

First, the person I was discussing this with pooh-poohed the price setting by claiming it was the result of manipulation of numbers. Maybe... maybe not. I suspect there is some of that involved but not to inflate the price but rather to lower it.

The next complaint was that the IPO is usually, if not always, restricted to certain potential buyers; he called them "select friends and family." That's not quite how it works. Family members are usually just awarded shares based on their interest in the company by virtue of being part of the founding family and/or position in the company. The "select friends" is also misleading since what happens usually is that there is a fixed number of shares and lots (batches of shares) are allocated to various brokerage houses based on some formula I am sure I would never understand. The brokerage houses then offer smaller lots from that to certain favored clients (I suspect these are selected on size of account and trading patterns).

The odd thing was that, after complaining about these things, he then offered that the stock price often went up quickly during the IPO period and then dropped to more rational prices when the rest of the investing public got access. I thought that pretty much negated his complaints.

Here's why I thought that: After the IPO, the stock usually falls to a rational price due to an unwillingness of the investors to pay an inflated price that was pushed up by speculation. If the IPO recipient neglected to dump the stock before it falls, they will likely see a loss... on paper at least. The advantage they had by being a "select friend" is negated.

Since no one is forced to buy stocks, I see no problem here. After the initial frenzy of buying, everyone is pretty much on equal footing. That, to me, is eminently fair.

No comments:

Post a Comment