Still, I like to have something new every day so I am trying a little stream of consciousness. That means this is just tumbling from my brain, down through my arms and out from my fingertips. I am tempted to leave in the typos just to make it more realistic.

I thought about commenting on the economy since it seems to be on everyone's mind these days. I feel a bit out of touch regarding this. As a retiree, I am on a fixed income. That could be bad but I made sure my debts were paid, my house paid off, and my expenses would likely not exceed my fixed income. So, the economic turmoils of the past year or two haven't greatly impacted me. I have only a little money invested in the stock market and I am having fun, actually, playing with that.

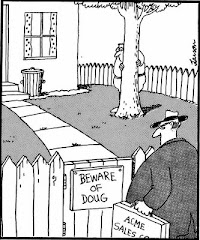

Anyway, that's why the Thing to Ponder and the Cartoon are about the economy. Unfortunately, I can't think of anything witty, clever, or acerbic to say about it.

Anyway, that's why the Thing to Ponder and the Cartoon are about the economy. Unfortunately, I can't think of anything witty, clever, or acerbic to say about it.I read an interesting piece this morning, an opinion column on Bloomberg.com, which basically said the bailouts are like a Ponzi scheme. At least, that's what I got out of it. It made sense to me that way. And then I started to think that economies are just Ponzi schemes.

In case you are unfamiliar with the term, a Ponzi scheme is a clever scam where the older investors are paid with the proceeds of the newer investors. Eventually, the scheme falls apart when the number of new investors is insufficent to support the number of older investors.

Since all economies depend upon growth, it would seem to me that all economies are the same kind of scheme. When the growth disappears, the bottom drops out. Certainly all governments are set up that way. Why else would they promote growth? Businesses are all designed that way. Sell more to pay for the previous investments in product. The stock market especially is designed this way.

The only real difference is there is no underlying value to the Ponzi scheme. Looking at the economies of the world today, I have to wonder whether there is any underlying value to them.

Just some food for thought.

4 comments:

I would say that yes there is an underlying value to a real economy, of course, but it is amazing how every few years the wave trends down and it shudders people all over again. What can go up fast and furious forever.

It seems my parents had a 1,000 square foot house, one car, no AC, 4 kids, one job, and a rotary dial phone. Now we are 'blessed', a young couple will have multiple jobs, two or more vehicles, maybe a Harley, several cell phones and Blackberrys, 3,000 square feet of living space, etc. So it's all relative I guess, even in our desperate straights and poor times we are really well off. Just doesn't fel like it.

Doulas, can you imagine what it must have felt like to be the current Ponzi operator? He is smart so he had to know the gig would end, that the day would come, or do you think he created such a big ball of waxy lies that he actually justified and convinced himself?

According to all the geniuses now might be the time to BUY BUY BUY stocks and such, in the strongest of the weak. Blood in the streets and it's darkest before the dawn and all that. It will come back, it probably won't take as long as some say.

Robot Nine

It all depends upon how much tinkering the govt does. The less the better, I think. With the bottom dropping out of the oil market and the bailouts for just about anyone with a good story, I expect to see Exxon-Mobil and their brethren panhandling in from of some Congressional committee soon.

Hi Douglas,

I admire your incentive to write everyday. I could never do it. It’s enough that I manage a couple blogs (if that) a week.

I’m an early retiree. (I retired at 53) and did exactly the same thing as you. (Isn’t it heaven NOT having a house payment?) -And I actually pulled everything out I had invested just 2 weeks prior to the big crash in August. I just got a feeling in July and decided to trust it. I’m glad I did. Can’t afford to loose it anymore.

I would like to hear your opinion on Robot Nine's 'Buy now'. Is this a good time to think about buying?

Vikki

Vikki - The sweetest feeling in the world is knowing you don't have to make a mortgage payment. I wouldn't be the one to give advice on where the bottom is in this market. There's still too many unknowns out there with a new administration coming in. Still, there are bargains out there if you have some "play" money and don't mind weathering what may be a storm. It's fun in a way; up a few thousand one day and down a few the next. Did I cover all bases? I sound like a broker. Past performance is no guarantee of future earnings.

Post a Comment