I think it is time for another question. Something to intrigue the curious, to initiate mischievousness in the clever and witty, yet something everyone can relate to.

But what subject? Maybe Bernie Madoff. Most of us didn't give him any money. But we might have some opinions about him and Ponzi schemes and about the ones who did lose money in that particular one.

I like that idea. Madoff, it turns out, is worth some $820 million plus. Since the losses are alleged to be some $50 Billion, that money had to have gone somewhere. I mean, we are talking about over 49 Billion dollars here. I am reasonably sure he didn't spend it all. Even with the help of his family, I am reasonably sure he couldn't have spent all that without some huge assets sitting around.

The way a Ponzi scheme works is pretty simple: You take money from investors and keep drawing in investors. As new ones invest, after skimming a bunch for yourself, you use that money to pay dividends to the earlier ones. Eventually, the schemes collapse because you run out of investors. Or because too many investors demand their principal back. Look at it like a run on a bank.

So who was hurt by Madoff? Mostly rich people who are complaining about losing millions. These are rich people who undoubtedly are not wiped out and have millions more in reserve so it is hard to feel bad for them. But I am told there were some charities who had invested with him and they will be hurt since they usually have no reserves at all.

The scope of this Ponzi scheme is what makes it so fascinating to us, I suppose. It went on for something like 20 years. That's a lot of new investors. I am reminded of P.T. Barnum's famous quote, "There's a sucker born every minute." Apparently, Madoff had the line on all the rich ones.

It does show one thing, though, even the rich aren't all that smart.

Oh, the questions (there's two)...

Have you ever been cheated in a Ponzi scheme?

Where do you think that $49 Billion went, if it was really that much lost?

[862/863]

9 comments:

I'm having a little difficulty analyzing the Madoff situation for several reasons. First many legitimate businesses function like Ponzi schemes, especially those who have a significant lag between doing the work and getting paid. We cash it cash flow. Large corporations in particular jack you around on getting paid on time and thus the smaller clients frequently have to contribute to your overhead.

Number two, the investors must have realized that there was high risk, since this guy was promising yields way behind his competitors.

Finally, number three, I am not clear as to whether the alleged "misrepresentation" had to do with the returns, the mechanism for achieving the returns, or the actual investments, if any there were. If he was not investing the money, and simply collecting it and then getting new customers, then arguably that was a fraud. I haven't examined the details close enough, and I'm not quite sure that the authorities have really disclosed them for obvious purposes.

a) see my last comment

b) I'm guessing there's a lot overseas, and a lot was lost on his own risky investments.

Bernie is claiming that he acted entirely alone. He is, of course, lying. If he told the whole truth we could find more of the money, but he wouldn't live very long. That kind of money attracts some nasty characters, $65 billion would make a drug lord drool, that is the brand of people old Bernie was dealing with. "...The love of money is the root of all evil." a wise man once said.

Log - 1)Your comment reminded me of my ex-wife. She would wait until the Final Notice letters would arrive before paying bills. Since I am of the mindset that says pay it as you get it, this caused no end of arguments. Her excuse was "it is standard business practice." 2)Greed has a way of blinding one's suspicious mind. 3) The SEC supposedly ran a cursory investigation on his company back in the 1990s and found no problems. A matter of clever bookkeeping, perhaps?

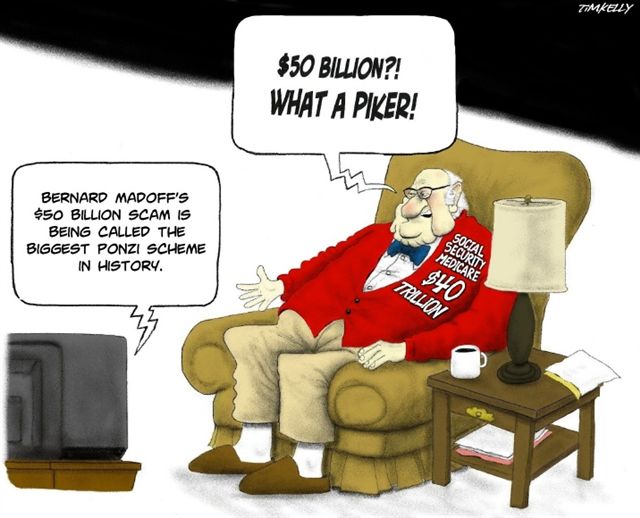

Steven - Yes, I thought you had stated your position well, the cartoon was primarily for your benefit. Maybe it went overseas and maybe a lot was lost on poor/risky investments but we are talking about $49 Billion! Some $5 Billion a year! More if we take Jonathan's figure of $65 Billion.

Jonathan - I am too much of a cynic to accept that theory. Could you toss Cesar Chavez into that mix?

No one has been taken in by a pyramid scheme? No one jumped into Multi-Level-Marketing (MLM) scheme that collapsed soon after entry? No one even suspected they were caught in one? Like Steven (and that cartoon) says, what about Social Security.

Apparently Ruth Madoff has a >$9M house in FL...

Steven - She could have 5443 more houses of that price with the missing $49 Billion.

Apparently Ruth Madoff has a >$9M house in FL...

No one has been taken in by a pyramid scheme? No one jumped into Multi-Level-Marketing (MLM) scheme that collapsed soon after entry? No one even suspected they were caught in one? Like Steven (and that cartoon) says, what about Social Security.

Post a Comment