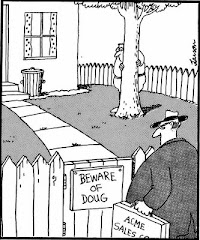

Words to live by...

"How beautiful it is to do nothing, and to rest afterward."

[Spanish Proverb]

(The right to looseness has been officially given)

"Everyone carries a part of society on his shoulders," wrote Ludwig von Mises, "no one is relieved of his share of responsibility by others. And no one can find a safe way for himself if society is sweeping towards destruction. Therefore everyone, in his own interest, must thrust himself vigorously into the intellectual battle."

Apparently, the crossword puzzle that disappeared from the blog, came back.

Pondering Financial Matters

I saw a headline that bothered me. Why would that headline bother me? Because it reminded me of some thoughts I had in the years before The Great Recession.

People often do not remember that the Clinton presidency gave us a recession at the end, which Bush inherited. The events of 2001 could have made it much worse but the administration (with the help of Congress) encouraged home buying. Which led to speculation on housing... which led to the games the banks played with derivatives... which led to the collapse... which we seem to be having great difficulty getting out of.

The headline suggested (to me) that they are at it again. Cheap loans encourage people to buy homes. But they also encourage people to speculate in real estate. Speculation leads to quickly rising prices which are good for the speculators but bad for people who want to buy homes to live in. The real estate industry then uses the rapidly increasing prices to urge people to buy and we end up with a sort of inflationary spiral, a "bubble", that will eventually (if it is not slowed down somehow) lead to a collapse in the housing market (the bubble pops). In the meantime, however, the bubble produces jobs and makes the economy look pretty good.

The idea behind home loans is that it gets easier to make payments as your income rises. And that is true... so long as the loans use a fixed rate for the term of the loan. But we now have variable rate loans. If your pay increases faster than the interest rate adjustments, you won't feel much pain and you will be fine. But if it doesn't? Then you will feel a lot of pain.

A lot.

2 comments:

Well that story's about Calif., and who knows what the heck goes on in Calif. -- they're putting down over half a million dollars and are still considered subprime? What I know is that housing is "hot" in New York City (maybe in Florida, too?), but not so much out here in the suburbs/exurbs where middle-class people live.

However, I am in the market to buy a car. And the salesman offered me 0 percent down on a car loan, no problem. So go figure.

Car dealers (and their sales staff) are desperate to sell cars so they offer 0% interest rates (if you qualify). I went to a dealership the other day and the salesman spent 45 minutes trying to convince leasing was good deal.

Post a Comment